2018 vs 2025 - Comparing Trump's Tariffs and What It Means For E-Commerce Business

Comparison of Trump's 2018 Tariffs vs. Proposed 2025 Tariffs

In 2018, President Donald Trump launched a series of tariffs as part of a trade war, initially targeting specific goods and countries. In 2025, Trump (in a hypothetical or second-term scenario) has proposed or enacted a new wave of tariffs that are broader and higher. The table below summarizes key similarities and differences between the 2018 tariffs and the 2025 tariff proposals:

Comparison Table

| Aspect | 2018 Tariffs (First Term) | 2025 Tariffs (Proposed/Second Term) |

|---|---|---|

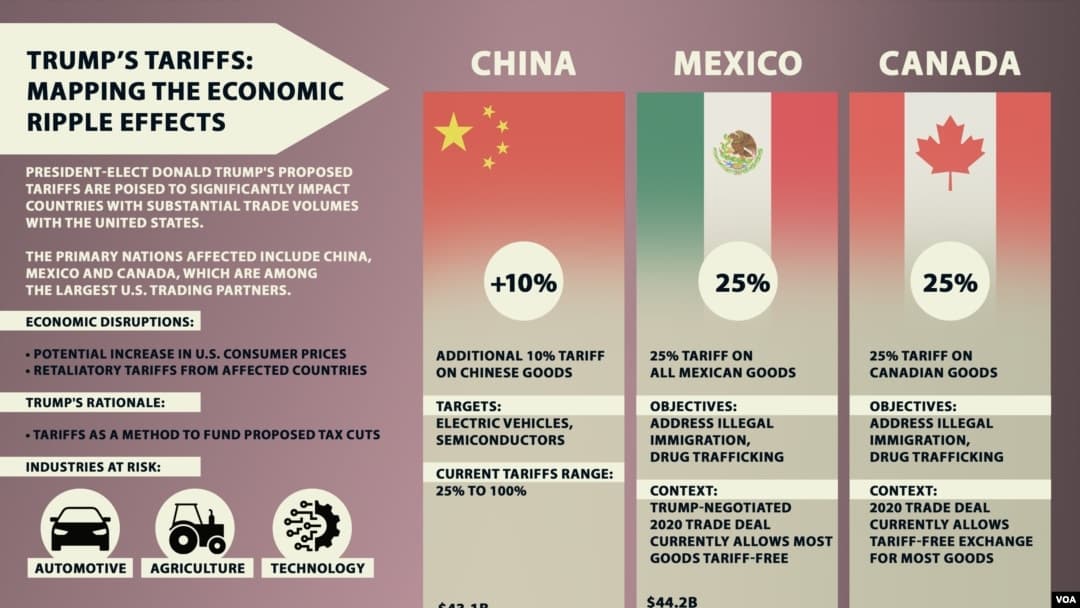

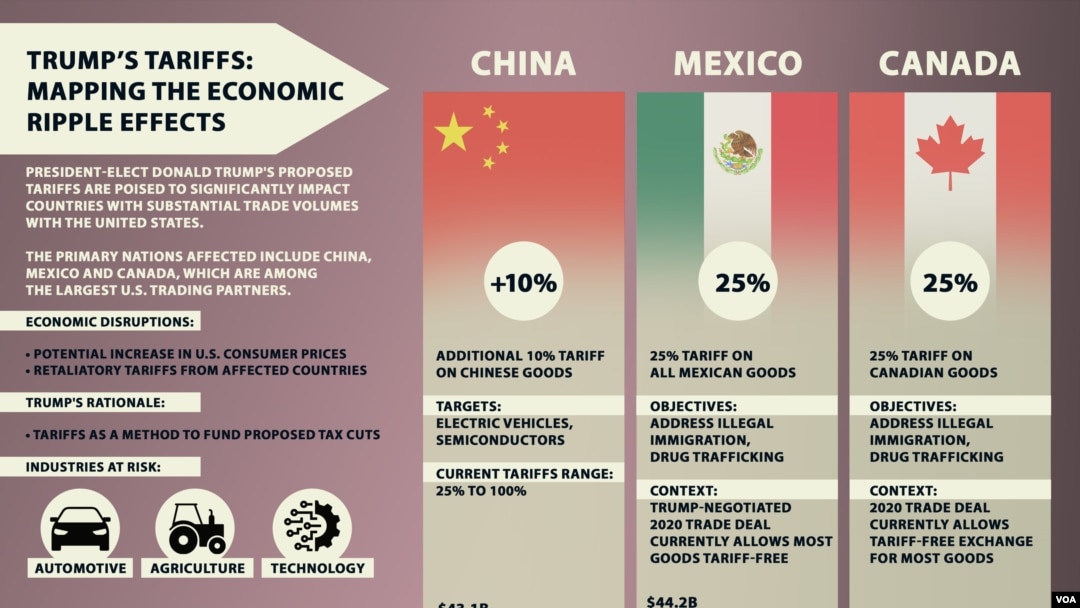

| Scope & Rates | Targeted tariffs on specific goods: 25% on imported steel and 10% on aluminum (with some exemptions); up to 30% on solar panels and 20% on washing machines. Multiple rounds of tariffs on Chinese goods (tariffs of 10–25% on $~250B of imports). | Sweeping tariffs on broad categories: 25% tariff on all imports from Canada and Mexico (except 10% on Canadian energy) and a 10% tariff on all imports from China. Additional plans for 25% tariffs on automobiles, pharmaceuticals, and semiconductor chips. |

| Countries Targeted | China was the primary target (via Section 301 tariffs for alleged unfair trade/IP practices), along with global tariffs on steel/aluminum affecting allies (Canada, EU, etc.) until exemptions/deals were made. NAFTA partners (Canada, Mexico) were initially exempted from metal tariffs but later included before a new trade deal (USMCA). | Neighbors and China are explicitly targeted. A 25% blanket tariff on imports from Canada and Mexico (non-energy goods) and 10% on China. Even other countries have been threatened (e.g. a brief 25% tariff threat on Colombia over immigration issues, later walked back). The tariffs are more geographically wide-ranging (covering all goods from entire countries). |

| Justification | Framed as protecting U.S. economic interests: national security (Section 232) for steel/aluminum, safeguarding industries/jobs, reducing trade deficits, and punishing intellectual property theft (China). | Framed as responding to a national emergency at the border: leveraging economic pressure to combat illegal immigration and drug trafficking (fentanyl) from Mexico, Canada, and China. Also aimed at reshaping trade terms deemed unfair to the U.S. (e.g. higher foreign tariffs on U.S. goods) and "reciprocal" treatment. |

| Implementation | Gradual and strategic: Rolled out in phases (e.g. Jan 2018 tariffs on washers/solar, Mar 2018 metals tariffs, mid-2018 to 2019 multiple tranches on Chinese imports). Often targeted specific sectors and allowed negotiations to delay or modify some tariffs. Retaliation by partners (China, EU, Canada, etc.) led to ongoing negotiations (e.g. Phase-One trade deal with China in Jan 2020). | Rapid and broad: Announced almost immediately in early 2025 and covering entire import categories by country. Initially set to begin Feb 2025, with a short one-month delay for Canada/Mexico after last-minute talks. Far less targeted – a "sledgehammer" approach instead of a surgical one, as noted by analysts. Retaliation is anticipated and the policy even includes a clause to raise tariffs further if partners retaliate. |

| Scale of Tariffs | More limited in average impact: by 2020 the average U.S. tariff on all imports roughly doubled to ~2.8% (from ~1.4% in 2017) due to Trump's tariffs. Tariffs applied to about $283 billion of imports in 2018 (rates 10–50%). Chinese imports faced up to 25% duties on roughly half of U.S. imports from China. | Dramatically larger in scale: if fully enacted, average tariffs on all imports could reach 17.7% – levels not seen since the 1930s. Virtually all imports from major trade partners are taxed at 10–25%, representing hundreds of billions in trade. For example, 100% of imports from Canada/Mexico (except oil) now face 25%, versus near zero under NAFTA/USMCA previously. |

| Economic Impact | U.S. consumers and firms bore the cost: studies found the 2018 tariffs raised consumer costs by ~$51 billion annually, amounting to about $625 per household per year. There was a net welfare loss of ~$7.2 billion in the initial tariff wave. Certain protected industries (steel/aluminum) saw output and investment up ~5%, but downstream manufacturers and farmers were hurt by higher input costs and foreign retaliation. Overall GDP impact was slightly negative (tariffs shaved an estimated few tenths of a percent off GDP) and inflation ticked up modestly. | Expected to have a larger economic impact due to breadth. Economists warn these new broad tariffs are "less targeted" and thus put more downward pressure on growth. S&P Global estimates a one-time 0.5–0.7% increase in consumer prices if the 2025 tariffs persist, and U.S. real GDP about 0.6% lower over the next year than it would be otherwise. Higher import costs could fuel inflation near ~3% by late 2025. Businesses and consumers would face wider price hikes as even untariffed items get costlier (a previous Fed study showed prices rose ~12% even for products related to tariffed goods). Retaliatory tariffs from Canada, Mexico, and China are likely, potentially harming U.S. exporters (as happened in 2018 when U.S. export growth in affected sectors lagged by ~2% relative to others). |

Similarities

- Use of Tariffs as Leverage: Both episodes see Trump using tariffs as a bargaining tool, leveraging U.S. market access to force policy changes (whether on trade terms or immigration).

- Higher Prices at Home: In both cases, American importers/consumers ultimately pay more for goods due to the tariffs (effectively a tax on imports).

- Retaliation and Trade Tensions: Both waves triggered retaliation from trade partners (e.g. China's counter-tariffs in 2018; expected countermeasures from Canada/Mexico/China in 2025) and introduced uncertainty for businesses.

Differences

- Targeted vs. Broad: 2018's tariffs were selectively applied (specific goods or specific countries for each action) and often exempted allies initially. 2025's are broad-based across entire countries/sectors with few exemptions.

- Rationale: 2018 was about economic issues (trade deficits, IP theft), whereas 2025 ties tariffs to non-trade issues (immigration/drugs) in addition to trade fairness.

- Magnitude: The 2025 plan is a more sweeping protectionist stance (potentially affecting a larger portion of U.S. imports and GDP) – "dramatically larger" than the first-term tariffs – raising average tariff levels several-fold higher than the 2018 episode.

Note: The 2025 tariffs referenced above were announced in early 2025 under Trump's proposals. As of February 2025, some measures (like the Canada/Mexico tariffs) were delayed in negotiations, and further adjustments remain possible. The situation is evolving, but the comparison highlights the general scale and intent of these policies.

Impacts on eCommerce Small Businesses and Artisans

Trump's tariffs – both the 2018 measures and especially the broader 2025 proposals – have significant implications for eCommerce business owners. This is particularly true for artisans and small businesses selling high-quality goods (e.g. handcrafted furniture) on platforms like Wix. Below, we analyze how these tariff changes might affect such businesses, focusing on product costs, shipping times, consumer spending (including cryptocurrency effects), market shifts, and even immigration policy impacts on labor and logistics.

Higher Product Costs and Prices

Tariffs increase the cost of imported materials and products, which can squeeze small eCommerce businesses' margins. When a tariff is imposed, foreign suppliers or U.S. importers must pay an extra tax that often gets passed along in the form of higher prices. Key points regarding cost impacts:

-

Rising input costs: If artisans source materials or components from abroad (e.g. specialty wood from Canada or hardware from China), those inputs now incur an extra 10–25% tax. For example, under the 2025 plan, most goods from Canada/Mexico carry a 25% tariff and goods from China 10%. This means a $100 item from Canada would cost $125 just in base cost due to the tariff. Businesses face either absorbing that cost hit or raising prices. In 2018, many U.S. companies reliant on imported steel, aluminum, or Chinese parts saw their costs jump when tariffs hit, forcing price increases or profit reductions.

-

Higher consumer prices: Ultimately, tariffs act like a sales tax on imported goods. Studies of the 2018 tariffs found that U.S. consumers paid the price: tariffs increased consumer costs by roughly $51 billion annually. That equated to about $625 per household per year in higher expenses during Trump's first term. For a small business selling handcrafted furniture, this means not only might their raw materials be pricier, but their customers are also facing generally higher prices on many goods. Consumers may become more price-sensitive if many products (furniture, appliances, electronics, etc.) get costlier due to new import duties.

-

Pressure on profit margins: Small eCommerce entrepreneurs often operate on thin margins. Tariff-driven cost increases present a tough choice: either increase retail prices (risking lower sales volumes) or eat the costs and accept smaller margins. In practice, many will do a bit of both – slight price hikes and cost-cutting elsewhere. For instance, an eCommerce seller might raise furniture prices modestly while trying to find cheaper shipping or cheaper packaging to offset some of the tariff cost. Guidance from industry experts suggests re-assessing pricing and possibly sourcing alternatives to mitigate rising costs. The risk is losing price-competitive edge, especially for price-sensitive customers. A 2025 analysis warned that businesses will need to reassess profit margins and decide whether to pass on added costs or absorb them.

-

Inflation and demand impact: The broader economy will likely see a bump in inflation from the tariffs. S&P Global estimates a one-time +0.5–0.7% rise in consumer prices if the 2025 tariffs stick. That general inflation means consumers' buying power goes down – effectively, their dollars buy slightly less than before. Small luxury or high-quality goods (like artisan furniture) might see demand dip if consumers cut back on non-essentials due to overall higher living costs. On the other hand, if a small business's products are Made in USA using mostly domestic inputs, they might become relatively more competitive (since competing imported products got hit with tariffs). Some artisan businesses could market their products as locally made to avoid the "tariffed import" cost stigma and potentially justify premium pricing.

In summary, eCommerce businesses should brace for costlier goods and materials, and likely plan for price adjustments. Historical data from 2018 showed clear cost increases for consumers, and the 2025 tariffs are even broader – so artisans and small sellers must plan for tighter margins or raise prices to maintain profitability.

Potential Increases in Shipping Time

Beyond costs, tariffs and related trade policies can also affect shipping times and logistics – a critical factor for eCommerce operations. There are a few ways this can happen:

-

Customs delays and stricter inspections: Tariffs can lead to more paperwork and checks at the border. For example, the 2025 policy removed the duty-free allowance for small packages from China, meaning even low-value ePackets now require tariff processing. This change has caused confusion and forced logistics firms to adjust, with Chinese shippers scrambling to handle new fees. More packages being subject to inspection and duty assessment can slow down customs clearance, causing delivery delays. Small businesses that rely on just-in-time imports or drop-shipping from overseas suppliers could see their shipments stuck in customs longer.

-

Border bottlenecks: When tariffs are used as leverage in disputes (especially intertwined with immigration issues), border personnel might be reassigned or borders subject to more scrutiny. We saw a real example in 2019: during a surge of illegal migration, hundreds of U.S. border agents were redeployed away from processing freight, leading to truck queues up to 12 hours at key U.S.-Mexico crossings. This kind of disruption, which was directly linked to immigration enforcement, shows how quickly shipping times can spike. In 2025, with tariffs explicitly tied to immigration control, there's a risk of similar scenarios. If border agents intensify checks on cargo to catch contraband (drugs, etc.), or if countries retaliate by slowing customs on U.S. goods, cross-border commerce can grind down to a crawl.

-

Supply chain rerouting: Facing high tariffs, businesses may switch suppliers or shipping routes, which can affect delivery times. A dropshipping guide notes that tariffs often force sellers to look for alternative suppliers in other countries (e.g. Vietnam or India instead of China). While this can save tariff costs, it might introduce longer transit times (if those countries are farther or lack the shipping infrastructure China has) and initial coordination delays. Changing a supply chain isn't instantaneous – vetting new suppliers and shipping arrangements can be a lengthy process. During the transition, some orders might take longer to fulfill.

-

Carrier adjustments and costs: Major carriers (FedEx, DHL, USPS) also react to tariff changes. If their costs rise (like DHL paying more to get goods through customs, or needing more staff for paperwork), they might prioritize certain shipments or raise prices for faster service. The cost of faster shipping options could increase, meaning small businesses might stick to slower, cheaper methods to save money – again lengthening delivery times to customers.

The bottom line is that eCommerce sellers could see shipping slowdowns in a tariff-heavy environment. This might be sporadic (e.g. a delay spike around tariff implementation dates as everyone rushes shipments) or persistent (slower average delivery if using alternate suppliers). Small businesses should prepare by communicating clearly with customers about potential delays, building in some buffer to delivery estimates, and possibly strategizing inventory (e.g. holding a bit more stock domestically to fulfill orders faster, rather than relying on last-minute imports). According to industry advice, tariffs "can slow down supply chains due to increased customs scrutiny," resulting in delayed shipments and even a higher risk of order cancellations if customers grow impatient. Managing customer expectations and proactive logistics planning will be key.

Cryptocurrency Markets (Dogecoin etc.) and Consumer Spending

While at first glance cryptocurrency (like Dogecoin) might seem unrelated to tariffs, there are a few connections in terms of consumer spending and small business sales. In an eCommerce context – especially for tech-savvy artisans or online businesses – crypto trends can influence how consumers spend:

-

Wealth effect and spending power: Cryptocurrencies are known for their volatility. A surge in crypto prices can create a wealth effect where holders of crypto feel richer and may spend more freely. Conversely, a crypto crash can tighten budgets for those who lost value. For instance, Dogecoin (a popular memecoin) saw a huge spike in 2021, making early adopters sizable gains; some of those gains likely translated into extra discretionary spending (including on eCommerce goods) or investments in small businesses. On the other hand, in early 2025 there were reports that market turmoil – partly sparked by economic policy changes like tariffs – hit cryptocurrencies hard, with Dogecoin dropping about 27% in value during a period of tariff announcements. Such a decline can dampen the willingness of crypto-holding consumers to spend; they might cut back purchases until their portfolios recover.

-

Crypto as a payment method: A growing number of online retailers and small businesses now accept cryptocurrencies as payment, including Dogecoin in some cases. This means that the state of crypto markets can directly affect sales for those merchants. If Dogecoin or Bitcoin is riding high, consumers holding those coins might be more likely to splurge on, say, a handmade furniture piece via a crypto payment, taking advantage of their appreciated assets. If crypto values tank, those consumers may hold onto their coins and be less inclined to spend them on purchases. In short, crypto-market prosperity can translate into higher eCommerce sales from crypto-savvy customers, while a slump could reduce that flow. (It's worth noting this is still a niche segment – for example, only a few percent of consumers hold currencies like Doge or Ether – but it's a growing niche, and many small business owners court these customers by accepting crypto.)

-

Alternative markets and decentralized platforms: The intersection of tariffs and crypto also raises the idea of alternative, possibly decentralized, marketplaces. There's emerging discussion about Web3 and blockchain-based eCommerce (for instance, Web3Bay is mentioned as a decentralized marketplace aiming to reduce fees and barriers for sellers). In theory, such platforms could allow artisans to reach global customers without traditional intermediaries. Cryptocurrency could facilitate cross-border transactions smoothly – a customer in another country could pay in crypto without worrying about currency exchange or certain trade restrictions. However, tariffs apply to goods physically crossing borders, so even if payment is in crypto, a physical product (like a chair) still faces customs. Crypto doesn't directly void tariffs, but it might enable more peer-to-peer sales or new channels that are outside traditional frameworks. Some enthusiasts argue that blockchain commerce could lower costs and prices for consumers by cutting out middlemen, which might help offset some tariff-induced price hikes in the long run. These are nascent developments, but small businesses are keeping an eye on crypto adoption as both a marketing angle and a way to possibly reach customers who are heavily invested in crypto.

-

Consumer sentiment and overlap with tech trends: Tariff news can rattle financial markets and reduce risk appetite. Crypto, being a risk asset for many, sometimes moves in tandem with stock market sentiment. If tariffs cause economic anxiety, investors might pull back from speculative assets like Dogecoin. A cautious consumer is less likely to make big discretionary purchases (whether in dollars or crypto). On the flip side, if crypto is booming independently, it could create a cushion of spending. For example, a person who made a windfall on Dogecoin might be more willing to buy a $2,000 custom table for their home. Additionally, some small businesses have started to list prices in crypto terms or offer discounts for crypto payments, effectively tapping into the crypto community's enthusiasm.

In summary, healthy crypto markets could somewhat bolster eCommerce spending (especially for businesses that accept crypto or cater to tech-forward audiences), whereas a downturn in crypto can remove a layer of spending power from certain customer segments. Dogecoin's cultural popularity (fueled by online communities and even Elon Musk's comments) means some customers get excited to spend it on real goods – many online retailers now accept it. Small businesses should weigh whether accepting cryptocurrencies might open new revenue streams. They should also be aware that broad economic shifts (like a tariff-driven slowdown or inflation spike) can spill over into crypto markets, which in turn loops back into consumer behavior. Keeping an eye on both traditional economic indicators and crypto trends can help eCommerce entrepreneurs anticipate changes in customer spending patterns.

Emergence of Alternative Markets and Supply Chains

One potential consequence of tariff changes is the emergence of alternative markets or shifts in supply chains. "Alternative markets" can refer to both alternative sourcing (where businesses get their supplies) and alternative sales markets (where businesses sell their products). Here's how tariff effects might drive changes in these areas:

-

Alternative sourcing and supplier diversification: To blunt the impact of tariffs, many businesses will seek suppliers in countries not subject to the new tariffs. In 2018, when tariffs on Chinese goods rose, some importers started looking to Vietnam, India, Mexico, or other countries for similar products. In 2025, with tariffs hitting China, Canada, and Mexico, the options become trickier (since two of those are the U.S.'s biggest trade partners). Still, businesses might pivot to suppliers in Europe, South America, or Southeast Asia that aren't facing across-the-board U.S. tariffs. A dropshipping resource notes that sellers are indeed researching suppliers in "tariff-free or low-tariff countries such as Vietnam, India…" and even considering more U.S.-based suppliers to avoid import taxes. For a furniture artisan, this could mean sourcing wood from domestic mills or non-tariffed countries, even if it's a bit more expensive than pre-tariff Canadian wood – it might still be cheaper than paying a 25% import duty.

-

Domestic market emphasis: If imported goods become pricier, locally made products can gain a competitive advantage. An artisan who handcrafts furniture in the U.S. might find that customers are now more inclined to buy "Made in America," since the price gap between domestic and imported furniture has narrowed (imports no longer enjoy a duty-free advantage). This could stimulate a more robust domestic artisan market, where small businesses market the quality and tariff-free nature of their goods. Essentially, some market share may shift from imported goods to domestic producers. This was part of the Trump administration's intent – to encourage more production in the U.S. – and we might see niche markets flourish domestically (e.g. a rise in U.S. boutique furniture brands) if tariffs persist. However, domestic producers might still face higher input costs (if they import any materials).

-

New export markets for sellers: On the flip side, U.S.-based eCommerce sellers might look abroad for customers if U.S. demand falters or if their input costs rise too much. For instance, a small business that finds U.S. customers unwilling to pay the new higher price might try marketing to customers in other countries. Tariffs don't follow the product beyond U.S. borders – a chair made in the U.S. can be sold to Europe or Asia without the U.S. tariff issue (though other countries might have their own import duties). If the dollar weakens due to trade tensions, U.S. goods could even become more price-competitive overseas. Thus, diversifying customer bases internationally could be an alternative strategy. That said, selling internationally brings its own challenges (shipping costs, different taxes, etc.), so it may be an avenue mainly for those already equipped for cross-border eCommerce.

-

Growth of secondary markets and substitutes: When new goods get expensive, consumers may turn to alternative products or markets. For example, if imported furniture prices jump, some consumers might buy second-hand or refurbished furniture (no tariff on used goods sales). We could see a boost in secondary marketplaces (like Facebook Marketplace, Craigslist, thrift and antique shops) – effectively an alternative market where tariffs don't apply because the goods are already in-country and pre-owned. Additionally, consumers might opt for substitute products: instead of an expensive imported item, they might purchase a different item that serves a similar function. Small businesses can capitalize on this by highlighting cost-effective alternatives or accessories. Adaptability is key; businesses might pivot their product lines to what is more tariff-proof.

-

Decentralized and niche online marketplaces: As hinted earlier, some startups are exploring decentralized eCommerce (Web3 marketplaces) which aim to reduce fees and barriers. These aren't a direct response to tariffs, but they do represent an alternative market structure. If tariffs contribute to a sense of de-globalization or fractured trade, the tech community might respond by building platforms that connect buyers and sellers more directly across borders (using crypto, smart contracts, etc.). While still early, these could become viable alternative channels for small businesses to reach customers globally without relying on giant platforms that might be subject to geopolitical pressures.

In essence, tariffs will push businesses to get creative. We're likely to see shifts like new supplier relationships, possibly increased local sourcing, and businesses targeting new customer segments or regions. Both 2018 and expected 2025 tariffs have already led to "supply chain diversification" discussions. Companies that adapt by diversifying – whether that means finding a supplier in a different country or tweaking their product lineup – will be better positioned to weather the tariff storm. Small eCommerce entrepreneurs should stay agile: explore new wholesale sources, consider partnering with domestic manufacturers, and even keep an eye out for emerging online marketplaces that could bypass traditional middlemen costs.

Impact of Immigration Crackdown on eCommerce (Labor & Logistics)

The final aspect to consider is how the broader policy environment – specifically, deporting illegal immigrants and tightening immigration – might affect eCommerce businesses. This was explicitly tied into the 2025 tariffs (tariffs on Mexico/Canada were justified as pressure to curb illegal migration). Key impacts include:

-

Labor shortages and higher wages: Many industries in the U.S. economy, from agriculture and construction to warehousing and transportation, rely on immigrant labor – including undocumented workers – for many roles. An aggressive deportation policy could shrink the available labor pool. Small businesses (and large ones) might struggle to fill certain positions, and wages could be driven up due to the shortage. For example, the restaurant industry is noted as one of the most reliant on undocumented workers; if mass deportations occur, it could face "pricier menus, rising wages, and shuttered storefronts," analogous to the shock of the pandemic. Similarly, eCommerce businesses rely on a network of labor: warehouse pickers/packers, delivery drivers, artisans or factory workers for production, etc. If even a portion of those workers are removed, remaining workers can command higher pay. While higher wages are good for workers, they translate to higher costs for businesses, which may then raise prices to consumers or face capacity shortfalls.

-

Warehouse and fulfillment operations: Large eCommerce players (like Amazon) have many fulfillment center workers, some of whom could be undocumented or on tenuous work status. A crackdown might force those companies to automate faster or pay more to attract legal workers. Small eCommerce companies often use third-party logistics (3PL) providers or local labor for packing and shipping – these providers could also see cost increases. Meeting customer demand might become challenging if labor is suddenly in short supply. One business commentary noted that many businesses employing immigrants could "suffer a shortage of workers if those workers are deported, and therefore will be challenged to meet demand". This is a real risk: orders could take longer to fulfill or even go unfulfilled if there aren't enough hands to pack boxes or drive delivery vans.

-

Logistics and delivery costs: The transportation sector (trucking in particular) has faced driver shortages for years, and immigrant labor has been one way to alleviate that. If undocumented drivers or warehouse staff are removed from the workforce, logistics companies may have to raise wages significantly to attract replacements. That can mean higher shipping rates for merchants. A small business might suddenly see their UPS/FedEx fees go up, or find fewer courier options in their area, especially in regions heavily dependent on immigrant labor. In agriculture, studies have shown deportation could disrupt harvesting and supply, which can indirectly affect prices and availability of goods that eCommerce food or textile businesses need. For product-based businesses, any disruption in the upstream supply (farms, factories) due to labor loss can ripple through in the form of delays or scarcity.

-

Reduced consumer base: It's also worth noting that immigrants (including undocumented ones) are consumers too. They rent apartments, buy food, clothes, and even furniture and other goods. Deporting a large number of people means fewer consumers in the economy – possibly a slight dip in demand for certain products. This might not heavily impact high-end artisan goods (as undocumented immigrants may have limited disposable income for luxury items), but local small businesses in diverse communities could feel an impact. For example, a small business selling specialty goods catering to immigrant communities could lose customers if those communities shrink.

-

Political and operational uncertainty: A climate of intensified immigration enforcement can create uncertainty for business owners and workers. Employers have to be more cautious about hiring and verifying work authorization, which might slow down hiring processes. Some small businesses might lose trusted, skilled employees and have to incur hiring/training costs for replacements. This kind of operational challenge is not directly financial like a tariff, but it distracts and strains small businesses, making it harder for them to focus on growth and customer service.

In summary, a policy of mass deportations or strict immigration enforcement can have a "supply-side" shock on the labor market. For eCommerce, that means potential delays in production and delivery and increased labor and logistics costs. The Brookings Institution and other economists have warned that removing millions of workers could "shrink the US workforce, drive up business costs and consumer prices, [and] reduce the overall economy's growth". For a small artisan business, this might translate to having trouble finding skilled craftspeople or helpers to make products, or paying more for basic services (like a local delivery or shop assistance). Small businesses should plan for possible labor tightness – for instance, investing in training and retaining existing staff – and perhaps consider automation or process improvements to rely less on manual labor.

It's notable that Wall Street analysts in late 2024 were skeptical that a full-scale deportation drive would actually happen, expecting a more limited approach. But the risk remains that if it did, industries from restaurants to retail could face pandemic-like labor disruptions. In the eCommerce world, that kind of disruption could mean slower shipping, less inventory turnover, and higher costs – all of which challenge small business survival.

Conclusion

In conclusion, Donald Trump's 2018 tariffs and the proposed 2025 tariffs both represent significant interventions in trade policy, but the 2025 proposals are far more sweeping in scope. The comparison shows that while 2018's measures were strategic and sector-focused, 2025's are broad-brush and tied to non-trade goals – with potentially greater economic fallout. For small eCommerce entrepreneurs and artisans, these trade policies and related factors (like immigration crackdowns) create a complex landscape. Business owners may have to navigate higher costs, adjust to possible shipping delays, keep an eye on cryptocurrency-fueled spending trends, seek out new markets or suppliers, and cope with labor market shifts.

Preparation and adaptability are key. This might involve strategic pricing, diversifying supply chains, building in logistics buffers, embracing new technologies (from accepting crypto payments to automating parts of fulfillment), and advocating for their interests in policy discussions. While tariffs aim to protect certain industries and address external issues, they also introduce challenges for small businesses that thrive on global connectivity and efficient supply chains. By understanding these impacts in depth – as we have analyzed above – entrepreneurs can make informed decisions to sustain and even grow their businesses in the face of changing economic tides.

Related Articles

10 Digital Products You Can Sell on Wix to Build a Thriving Online Business

Discover the diverse range of digital products and services you can sell through Wix's e-commerce platform. From online courses to mobile apps, learn how creato...

2024 E-commerce Platform Pricing Comparison: Find the Most Affordable Solution

Looking for the most budget-friendly e-commerce platform? We've compiled a comprehensive comparison of pricing across all major e-commerce platforms, including ...

Complete 2024 Ecommerce Platform Pricing Comparison Guide: All Platforms Analyzed

Looking for a comprehensive comparison of ecommerce platform costs? This detailed guide breaks down pricing for every major platform, from Shopify to WooCommerc...